Taxable income formula

How to Calculate Taxable Income. Revenues Deductions Taxable Income Revenues Revenues is any income your business earns.

Taxable Income Formula Examples How To Calculate Taxable Income

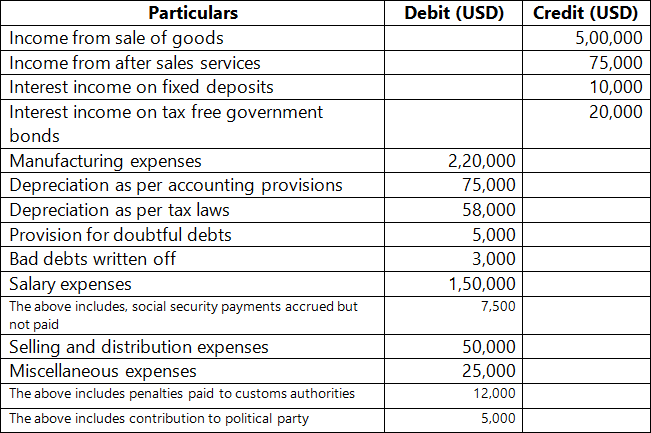

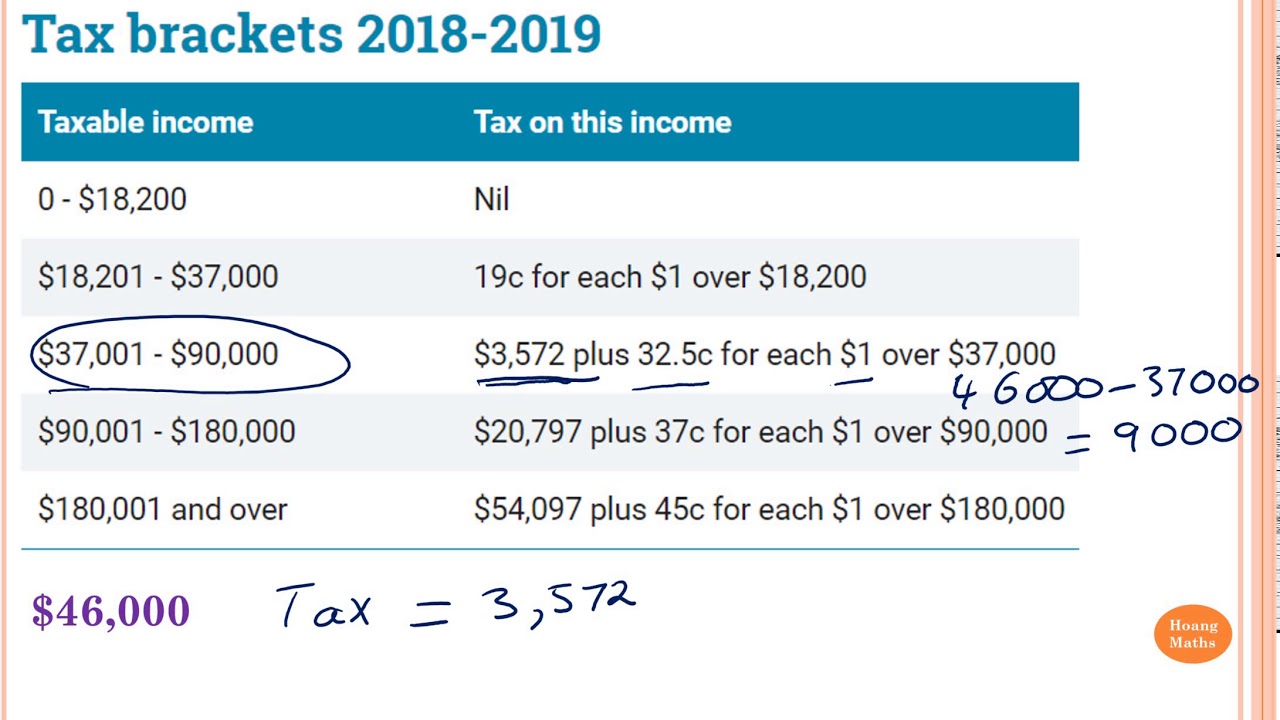

Therefore the taxable income becomes more than 57000 510006000 calculated with the same tax rate of 35.

. Theres no hard and fast formula for calculating taxable income as your total taxable income depends on your tax deductions filing status and the standard deduction. Calculating taxable income is very easy and hassle free. In general any revenue is taxable unless IRS rules specifically exclude it.

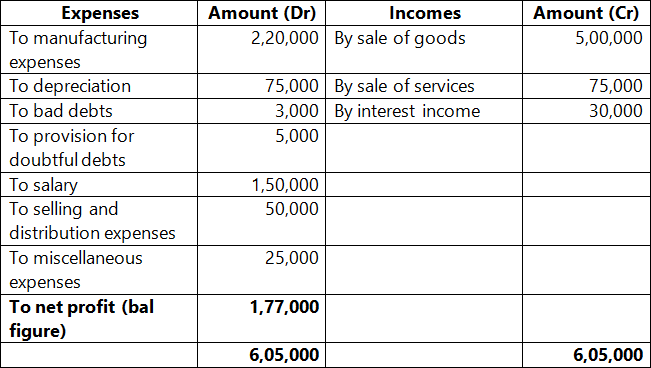

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. So to be sure about paying taxes heres a list of the types of income. Net income 40000 - 20000 20000 Wyatts net income for the quarter is 20000.

Income Tax Payable for an individual. Investment and business income. Allowable deductions from gross income including certain employee personal retirement insurance and support expenses.

Gross income 60000 - 20000 40000 Next Wyatt adds up his expenses for the quarter. Divide the companys income tax liability by its taxable income. For 2021 you can contribute up to 19500 to a 401k plan.

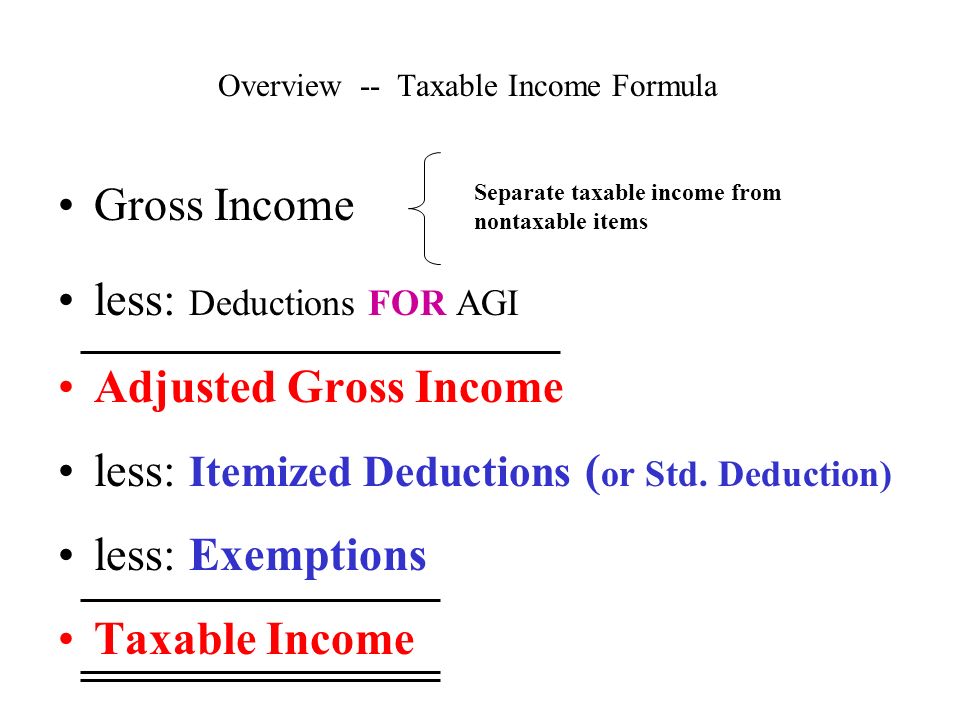

Now your taxable income is 39650 51200 salary 1500 401k contribution 2500 in other income 12550 standard deduction. You can calculate your taxable income in a few simple steps. You can think of it like a formula.

The tax levied on every individual is different depending on their income. The tax payable will be thus 19950. Your gross revenue includes all income received from sales after you subtract things like returns and discounts.

Taxable income total income gross income - exempt income - allowable deductions taxable capital gains. Its a simple formula you tell him. In tax terms income is the total gross income you earned during the tax year less exempt income.

How to Calculate Taxable Income. Federal taxes State taxes Total Taxes 74K views How to Calculate Taxable Income The gross income is the total amount a person. Thats because the IRS allows you to claim certain deductions that reduce your gross income to arrive at taxable income.

Expenses you can subtract from adjusted gross income to determine your taxable income. Ad See If You Qualify To File For Free With TurboTax Free Edition. If youre age 50 or above you can contribute an additional.

Employee compensation and benefits These are the most common types of taxable income and include wages and salaries as well as fringe benefits. You remain in the 12 tax bracket while saving for retirement. Income tax payable by an individual is different from that of a business.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Taxable income only represents the taxable portion of a companys profits. An amount of money set by the IRS that is not taxed.

Divide the companys total tax liability by the statutory tax rate listed on the governments tax table to calculate taxable income if it is not available separately. Expenses 6000 2000 10000 1000 1000 20000 Now Wyatt can calculate his net income by taking his gross income and subtracting expenses. Taxable income is defined by Internal Revenue Code IRC section 63 on gross income less allowable deductions.

Gross income is the amount of worldwide income that you earned during the tax year excluding income that is of capital nature. The result is the average tax rate for. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Gross Income x Tax Rate Taxable Income Calculating Taxes. Personal income tax payable by individuals differs according to their income category. Again you explain the timing of both.

The tax levied is governed by Indian Income Tax Act 1961The income tax received by taxpayers is the main source of funding for the public services in the country.

Taxable Income Calculator Discount 52 Off Www Quadrantkindercentra Nl

California Tax Expenditure Proposals Income Tax Introduction

Calculate Tax On Income Online 56 Off Www Wtashows Com

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Chapter 3 Calculate Taxable Income Personal And Dependency Exemptions Ppt Video Online Download

2020 Tax Calc Deals 52 Off Www Wtashows Com

Accounting Income Vs Taxable Income Definitions Meanings Differences Termscompared

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Taxable Income Formula Examples How To Calculate Taxable Income

Calculating Tax Payable Part 1 Youtube

Accounting Income Vs Taxable Income Definitions Meanings Differences Termscompared

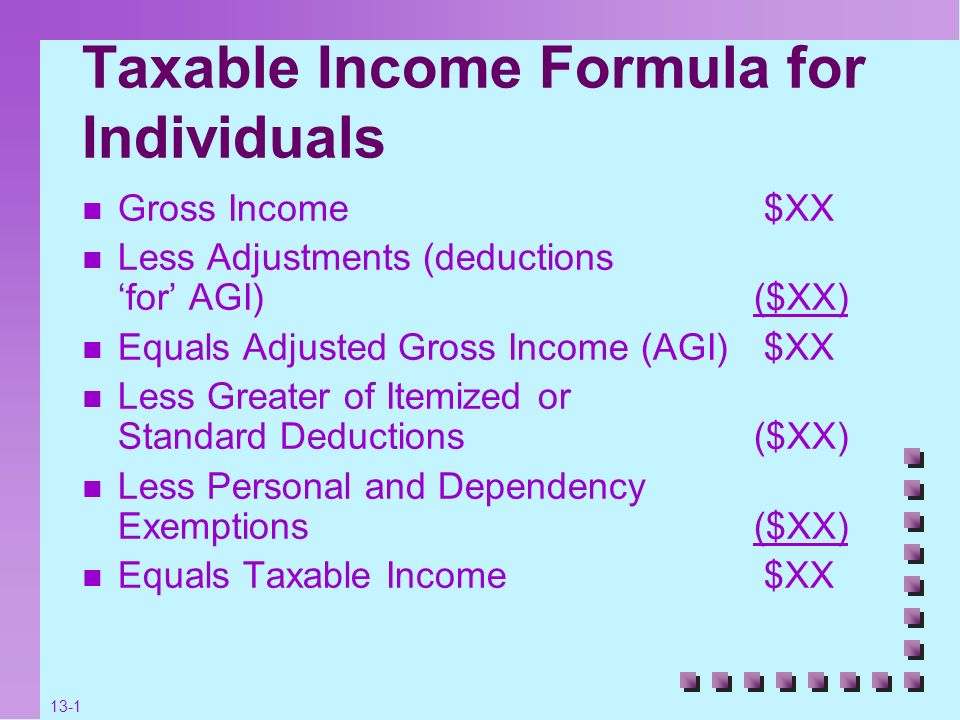

Taxable Income Formula For Individuals Ppt Video Online Download

2020 Tax Calc Deals 52 Off Www Wtashows Com

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income What Is Taxable Income Tax Foundation